Important update!

This article has since been updated in response to regulatory changes. For example, the Flemish government has moved the deadline for the solar panel requirement to April 1, 2026, and some other important adjustments have been made. Click here to read the updated article.

In pursuit of a more sustainable future, the Flemish government has taken important steps to encourage companies to install solar panels. On the one hand, there is an obligation for large consumers to install solar panels by June 30, 2025, and on the other, there are increased investment deductions that make this investment more financially attractive.

Obligation for wholesale consumers

Companies in Flanders with annual electricity consumption of more than 1 gigawatt hour (reference year 2021) are required to install solar panels on their buildings by June 30, 2025. For government buildings, this threshold is 250 megawatt hours (MWh) per year. The obligation rests on owners, leaseholders and superficies of the buildings in question.

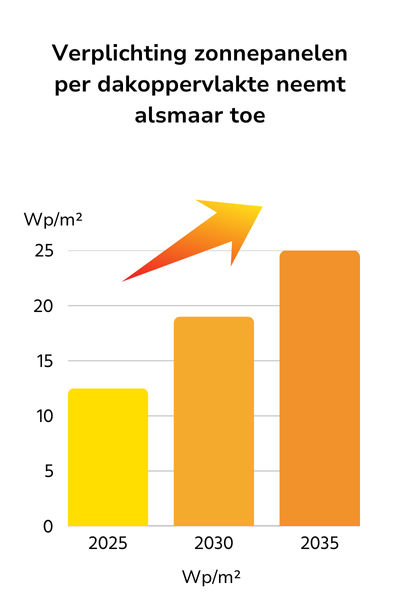

The minimum required solar panel capacity depends on the total horizontal roof area and is increased incrementally:

- By June 30, 2025: minimum 12.5 watt peak (Wp) per m²

- By Jan. 1, 2030: minimum 18.75 watt peak (Wp) per m²

- By Jan. 1, 2035: minimum 25 watt peak (Wp) per m²

This applies to the total available roof area, without taking into account areas that are not suitable for a standard solar panel installation. As a result, older buildings, large logistics centers with limited roof stability and, for example, horticultural companies with greenhouses also fall under this requirement.

Stability studies show that 40% of company roofs in Belgium are not suitable for standard solar panels, making this measure a major challenge for many companies.

Source: Flanders.be : Obligation of solar panels for buildings with high electricity consumption

Fines and exceptions

Companies that fail to comply with the PV requirement risk an administrative fine of €400 per missing kilowatt peak of installed power.

This fine is non-exempt, which means that paying it does not relieve you of the obligation to still install the required solar panels. For large installations, these fines can be significant, possibly into the millions of euros.

Important!

Recently, the Flemish government announced that companies that, before June 30, 2025 Have contracted for the installation of solar panels, can be given an extension until April 1, 2026 to meet the obligation. This relaxation gives companies additional time to make the necessary installations to avoid fines.

Make sure you have made your preparation before 30/06/2025 regarding a solar panel installation. The installation itself should not be done before this date.

Lightweight solar panels as a solution

For businesses with roofs that do not have the necessary load-bearing capacity for traditional solar panel installations, we offer lightweight solar panels an appropriate solution.

These panels are significantly lighter than standard solar panels and can be installed without major modifications to the roof structure. Thanks to innovative materials and smart mounting systems, companies with limited roof stability can still meet their obligations while enjoying the financial benefits of solar energy. Moreover, lightweight solar panels help companies make their energy consumption more sustainable without having to invest in expensive roof reinforcements or additional structures.

Click here for a comparative study between normal and lightweight solar panels.

Lightweight solar panels are adhered to the roof skin or on a PVC chassis. As a result, lightweight installation weighs only a fraction of conventional solar panel systems.

Case study

The challenge

A medium-sized food production company with high energy consumption faced the new requirement to install solar panels. With a roof area of 15,000 m² and an annual consumption of 1,246 MWh, they had to According to the law, install 188 kWp of solar panels by June 30, 2025.

The problem

Their roof was outdated and not rated for heavy solar panels. Moreover, there was little time to find a solution. The fine for noncompliance? €75,200 - a huge cost that the company absolutely wanted to avoid.

The solution

The company chose lightweight solar panels, eliminating the need for expensive roof reinforcements. Thanks to this innovative solution, the mandatory installation could be done. They invested in 470 panels with a total capacity of 188 kWp, thus not only avoiding the fine, but also drastically reducing their energy consumption.

Thanks to the increased investment deduction of 40% and a tax benefit of 10% net investment was significantly reduced.

- Gross investment: €234,000

- Fiscal benefit 10%: €23,400

- Net investment: €210,600

- Annual energy output: 153 MWh

- Electricity cost savings: €26,010 per year

- Internal rate of return (IRR): 12.35%

- Payback period: 8.1 years

Result

No penalty, lower energy costs and a future-proof sustainable solution!

Increased investment deduction

To support companies in this investment, the federal government has increased the investment deduction for solar panels.

- For small businesses, this deduction has been increased to 40%, representing a tax benefit of 10% of the investment cost.

- For large enterprises, the deduction is 30%, accounting for a benefit of 7.5% of investment costs.

This increased deduction also applies to investments in batteries and 100% electric heat pumps. However, there is a condition: the internal rate of return (IRR) of the project should not exceed 13%, including the tax benefit. This corresponds to a payback period of about 7 years or less.

As a result, companies investing in the more expensive lightweight solar panels stand a good chance of qualifying for this tax benefit.

The IRR (Internal Rate of Return). is a way of calculating how profitable an investment is over a given period of time. Simply put, it indicates how many percent return you make annually on your investment.

The IRR (Internal Rate of Return). is a way of calculating how profitable an investment is over a given period of time. Simply put, it indicates how many percent return you make annually on your investment.

Suppose you invest €100.000 in solar panels and thus saves €15,000 per year on energy costs. Then your IRR would be around 15% lie, meaning your investment will pay for itself in a relatively short time.

How do you interpret the IRR?

- A higher IRR means your investment becomes profitable faster.

- In Belgium, a IRR of 10-15% as very attractive considered for business investment.

- For solar panels, a IRR of at least 7% often seen as a good thing because it allows you to recoup your entire investment within 7 to 10 years.

Why is this useful for your business?

The IRR helps you to compare Whether an investment in solar panels is more interesting than other investments you can make. Solar panels often have a higher IRR than a savings account or traditional investments, because you save directly on energy costs.

Why investing in solar panels now pays off

For businesses in Flanders, this is the ideal time to invest in solar panels.

The combination of the legal obligation and the increased investment deduction makes the move to renewable energy both necessary and financially attractive.

By investing now, companies not only comply with regulations, but also enjoy tax benefits and contribute to a greener future.

Book a 10 mins Discovery Call

Is your business affected by the mandatory solar panel scheme? Would you like to gain quick insight into What this means for your situation and what solutions are there?

In just 10 minutes discuss your options and how you can respond smartly to this legislation - without unnecessary cost or risk.